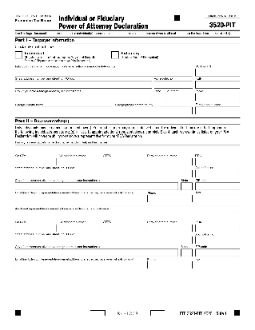

California Franchise Tax Board Power of Attorney Form 3520

The FTB form

The tax authority has put the FTB 3520-PIT form to show who the representatives are and what power they have on your behalf. In order to get the best services, the taxpayer is required to use the latest available form so that the authorities can process the POA. The latest version of the form FTB 3520-PIT (REV 2020) can be found here: Power of Attorney California Franchise Tax Board Form 3520.

In addition to the official 3520-PIT document, there are a few other Power of Attorney Forms that the Franchise Tax Board accepts as legitimate. They are:

- General Power of Attorney in California or Durable Power of Attorney declarations.

- A joint Board of Equalization/Franchise Tax Board/Employment Development Department Power of Attorney (This document can also be filled out or downloaded here and is known as the BOE POA Form 392).

- IRS Power of Attorney and Declaration of Representative (Form 2848) or IRS Tax Information Authorization (Form 8821), if you modify to state that they apply to Franchise Tax Board matters.

- Handwritten authority documents.

Powers delegated via the form

The taxpayer or the account holder has their own powers, but a power of attorney stipulates that the agent-in-fact also has powers on several matters. This includes receiving and inspecting the persons account details, representing the account holders on several matters concerning the Franchise Tax Board, signing waivers that will extend the period used in the assessment, and determining the tax issues. It is also used in the execution of settlements or agreements closing.

In addition, you can increase or decrease their powers within the POA agreement. For instance, you may want to have them receive your refund check (but not cash it) or create another POA delegate or substitute.

Any representative attorney has the power to sign the individual order in either of two circumstances: when one is ailing or injured or when one cannot be on the US soil two months before the agreed date.

The validity of the CA tax POA

The California franchise tax board POA can be used until the time when one of the following happens: death of the person paying the taxes, the revocation of the power of attorney form by the holder or the representative, incompetency of the account holder if it has not been authorized, or finally, the representative having the power to resolve the named matters that have been listed on the form.

Here are several caveats on the actual state-supplied FTB POA form:

- If another POA assigns someone to represent you and your finances (an Estate Power of Attorney or a Durable Power of Attorney) for the same tax periods, it will automatically be revoked, and the new one you create put in its place.

- Both spouses must authorize an FTB POA.

- You cannot designate a company or organization as your attorney-in-fact.

- You cannot specify all tax years (you can by listing them specifically like “2015-2021,″ but for the most part, you list the years in question like “2020-2021,″ and the representative can only deal with (and have access to your records) for those years.)

When signing the POA form, everyone must take care and avoid common mistakes. Any form with these mistakes will not be processed, but the tax board will inform you of this. Some of these errors include tax years not completed, the information on the FTB and the power of attorney not matching, the use of a non-FTB POA form, and listing a company as the representative instead of an individual attorney.

An individual can revoke the POA if they wish in California. A representative also has the power to revoke the POA. The procedure is to fill out the same form, write REVOKE in all caps across the top of the form, and send it to the FTB in California.

So that is some cursory information on what an FTB POA in California is. For more detailed and official information, as well as any up-to-the-minute changes to forms or by-laws, you can visit the California Franchise Tax Board’s website.